Cz warned Don’t buy high and sell low. Don’t make both mistakes. While this is a golden principle, new cryptocurrency investors often wonder what strategy is best to avoid this mistake.

Is it to HODL or Trade?

It’s popular to hear the statement ‘HODLers are winners’ on Crypto Twitter(now called X) which can lead you to think that’s the best strategy but trading also has benefits and can reward you if done right.

Understanding The HODL Strategy

HODL is an intentionally misspelled word, derived from the word Hold. It means the practice of holding onto your cryptocurrency assets for an extended period, regardless of short-term market fluctuations.

As a crypto investor, holding assets for a long time can help you potentially increase your gains.

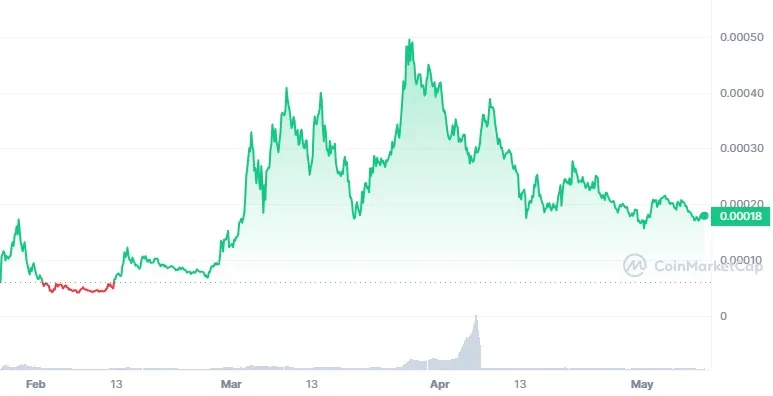

For example, the Jupiter team airdropped 643652 $wen tokens worth around $40 in January.

A few months later, in March, it went as high as $289 for the same amount of tokens.

Most people aren’t great traders. So HODLing can work for them because it is a straightforward strategy that requires minimal active management.

You buy your chosen assets and hold onto them, allowing them to appreciate over time.

By HODLing, you avoid the stress and potential losses associated with short-term market volatility.

Instead, you focus on the long-term growth potential of your investments.

However, there are common disadvantages of this strategy:

- Buying at the Peak: Many new investors are drawn to cryptocurrency during periods of high prices, driven by the excitement of a bullish market. However, purchasing assets at their peak means facing a challenging journey ahead. HODLing through subsequent price drops can be psychologically taxing, especially for inexperienced investors. Watching your wealth diminish by significant percentages can be disheartening and may lead to panic selling.

- Lack of Profit-Taking Experience: HODLers often find themselves unprepared when it’s time to take profits. Having become accustomed to simply holding onto their assets, they may struggle to recognize the right moment to sell. This reluctance to cash out can result in missed opportunities for profit, as well as holding onto assets during market downturns when selling would be more prudent.

- Risk of Holding to Zero: By HODLing through market fluctuations without a clear exit strategy, investors risk holding onto their assets until they become worthless. This is particularly problematic for those who bought at the peak of a market cycle and are ill-prepared for a subsequent crash. Without a plan in place for navigating bear markets, investors may find themselves stuck in a downward spiral with no clear way out.

Understanding The Trading Strategy

Trading involves buying and selling cryptocurrency assets frequently to profit from short-term price movements.

Unlike HODLing, where you hold onto assets for the long term, trading demands continuous market monitoring and decision-making based on immediate price trends and indicators. This active approach offers the potential for higher returns but also carries heightened risk, necessitating a thorough comprehension of market dynamics to navigate effectively.

Doing proper research, understanding your risk level and keeping your emotions in check can help you become a successful trader, however, trading is not without its drawbacks:

- Market Fluctuations: Although it is advised that you trade after doing good fundamental or technical analysis, the market can sometimes take a nose dive without warning, for instance, the fall of FTX, and the Luna crash.

- Limited Potential Gains: Trading involves exploiting short-term market fluctuations, and while this can generate profit, you risk of missing out on long-term gains. For example, trading Bitcoin at $12 to $30 could make you profits, but not as high profits as HODLing Bitcoin from $12 to its current all-time high of $73,000.

Factors to Consider When Choosing Your Strategy

When deciding between HODLing and trading, consider the following factors:

- Risk Tolerance: Are you comfortable with the potential ups and downs of the market, or do you prefer a more stable, long-term approach?

- Time Commitment: Do you have the time and resources to actively manage your investments, or do you prefer a hands-off approach?

- Financial Goals: What are your investment objectives? Are you looking for steady, long-term growth, or do you seek higher returns through active trading?

Answering the above questions can provide you with an answer on which strategy is best for you as a cryptocurrency investor.

Choosing Your Strategy With Second Mountain

At Second Mountain, you can explore both strategies with minimal risk. Our products: HODL and Time allow investors to choose mutual funds that match their risk level and trade using our bot for a commission on profits, respectively.

With a $10,000 starting capital in HODL, you can invest in our thoroughly vetted crypto assets (some of our customers already saw a 58% portfolio increase in the last 3 months). Our in-house analysts also continue to modify the funds so only valuable assets are in your portfolio.

For our trading bot: TIME, we monitor and execute preset entry and exit to help you take advantage of market fluctuations.

With Second Mountain, it’s no more a matter of choosing one strategy or the other, but a matter of how much profit you are looking to make and with what frequency.

We allow you to choose your preferred custody option; full custody or joint custody, and you can easily diversify your portfolio. You can join the waitlist to use our products.