Bullish Case for Aerodrome

Aerodrome Finance is an automated market maker (AMM) on Base’s network, setting a new standard for liquidity provision using innovative features including a robust liquidity incentive engine and a unique vote-lock governance model.

Aerodrome’s Unique Mechanics

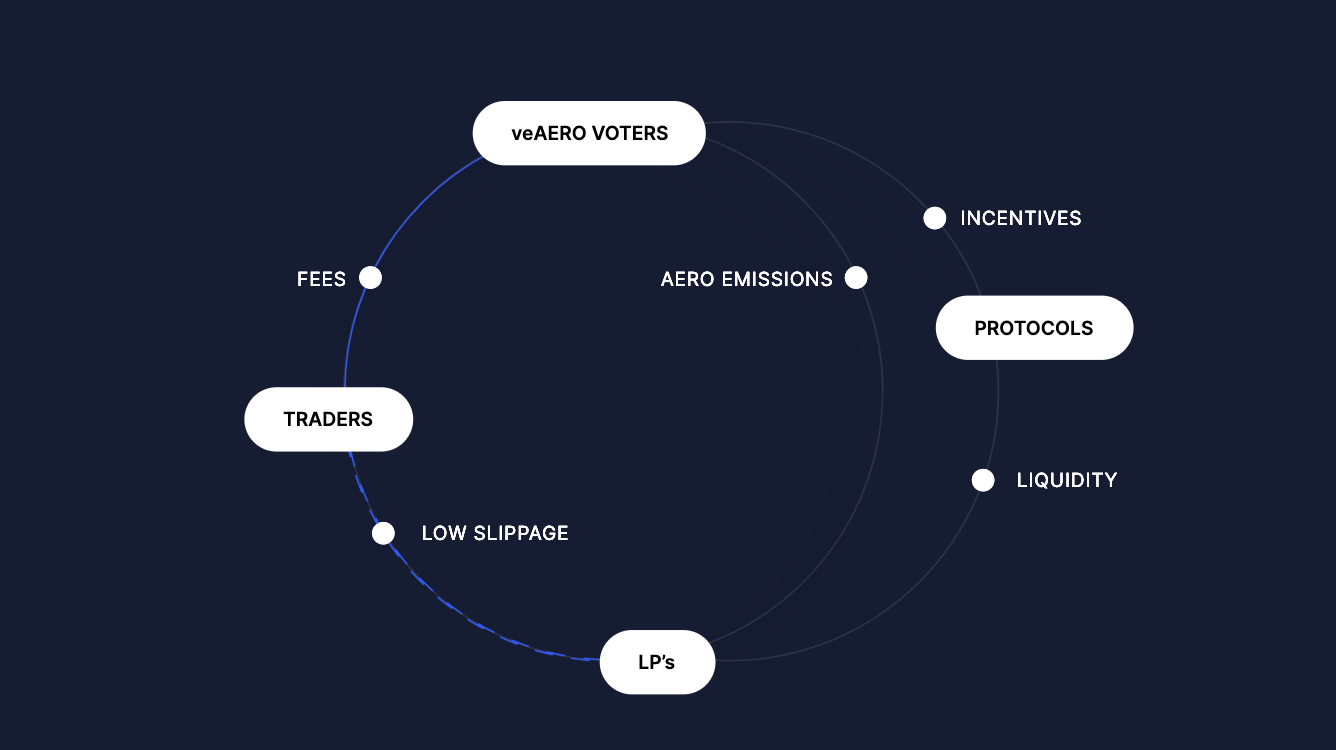

Aerodrome’s protocol is designed to facilitate token swaps and generate fees from traders by attracting liquidity. Every epoch, liquidity providers (LPs) receive $AERO token emissions based on the votes accumulated by their pools.

These emissions are distributed only to staked liquidity, ensuring fair rewards. Participants can lock their $AERO tokens to vote on the distribution of emissions in the next epoch, becoming veAERO Voters. These voters are rewarded with 100% of the protocol’s trading fees from the previous epoch, proportional to their locked amounts.

Onchain Metrics and TVL

Aerodrome commands a significant portion of the Base’s total value locked (TVL), with over $139M in its coffers. Impressively, Aerodrome’s revenue has soared, reaching over $262K in just 24 hours. These metrics underscore its popularity and utility within the DeFi space

Tokenomics and Emissions

Aerodrome Finance utilizes two tokens to manage its utility and governance: $AERO and $veAERO. $AERO is an ERC-20 utility token distributed to liquidity providers through emissions, while $veAERO is an ERC-721 governance token used for voting. The protocol’s emission schedule follows a structured approach, with weekly emissions starting at 10M $AERO and following a phased increase and decay pattern over time.

Coinbase Listing and Backing

Aerodrome’s recent listing on Coinbase, one of the world’s leading cryptocurrency exchanges, marks a significant milestone for the project. With backing from Coinbase Ventures and the Base Ecosystem Fund, Aerodrome is poised for rapid growth and adoption within the DeFi community.

Price Targets and Outlook

With a minimum price target of $5 and a maximum target of $15, Aerodrome presents an attractive investment opportunity. Current price levels at $0.0705 offer a favourable entry point for investors looking to capitalize on the platform’s growth potential and we expect it to hit a minimum price of $5 and a maximum price of $15.

Aerodrome Finance is an automated market maker (AMM) on Base’s network, setting a new standard for liquidity provision using innovative features including a robust liquidity incentive engine and a unique vote-lock governance model.